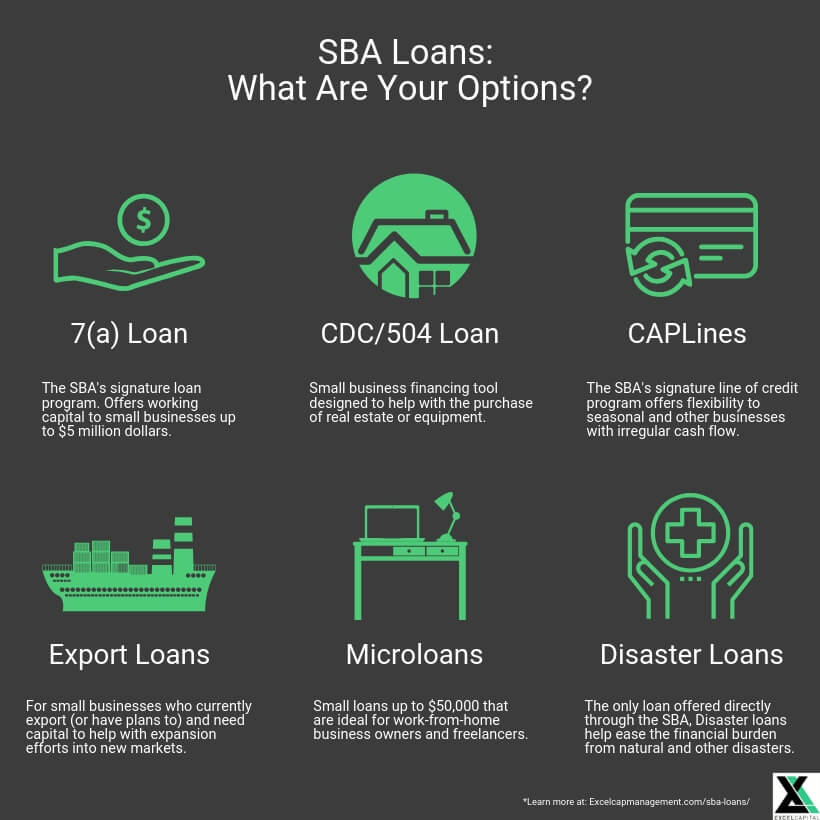

It’s likely you’ll need to provide business and personal tax returns and bank statements, business financial statements, business legal documents and your business plan. Prepping these documents beforehand can make for a more seamless process. Before you apply, check with your lender to learn about the required documents. Online lenders usually have more flexible requirements and quicker funding times, but it comes with more expensive options. Traditional lenders typically have more eligibility requirements but often have more affordable offers. You have a couple of options when it comes to choosing a lender: You can choose a traditional lender, like a bank or credit union, or an online lender. Your desired purpose will direct you toward the best lending product, such as an SBA loan, term loan, line of credit, invoice factoring or merchant cash advance. If you’re getting a business loan, it’s likely you want the funds to start your business, finance day-to-day operations or grow your current business. Most lenders will want to know the purpose of your loan. Determine what you need financing for.And many lenders require you to have been in business for at least one or two years, and show $50,000 to $250,000 in annual revenue. Small Business Administration (SBA) will typically require scores of at least 670 online banks may have more flexible requirements. Traditional banks and lenders approved by the U.S. You’ll want to know your personal credit score, time in business and annual revenue when applying for a business loan.

Sba loan calc how to#

How to Get a Business Loanįollow these five steps to get a business loan:

Use the calculator to determine if you can afford the business loan you’re considering, or if you might need to find a less expensive option. Next, click submit to see your estimated monthly payment and total interest paid over the life of the loan.

To use this business loan calculator, type in the amount you’ll need to borrow, the interest rate and the term (in months). On National Funding's Website How to Use This Business Loan Calculator

0 kommentar(er)

0 kommentar(er)